Home prices soared in late 2016 to the surprise of many, after falling by about 4 per cent between 2015 and 2016. Developers quickly pushed large numbers of pre-sale units onto the market at very high markups. The government responded quickly by slapping on an additional punitive stamp duty in a bid to cool down what was perceived as renewed speculative fervor.

This was a mistake. There are no speculators or short- or medium-term investors in the property market anymore, only final users and long-term investors with excess liquidity. Buyers today are more concerned about affordability than appreciation potential over the short or medium term.

The recent rise in property prices has been spurred by two factors. One is the public’s perception of the economic future and the implication for their home purchase decisions. The other relates to why developers have rushed to push units onto the market with high markups: the pre-sale market is being crushed under a ton of regulations.

Perceptions of the Economic Future

Throughout most of 2016, interest rates were widely anticipated to rise and many forecasted home prices would finally correct after trending upwards since 2003. The Federal Reserve had expected to raise interest rates four times. But it gave up because of global frailties.

The past decade has been marked by false dawns, in which optimism about economic recovery at the start of each year was undone – whether by the euro crisis, wobbles in emerging markets, the collapse of the oil price or fears of a meltdown in China. The US economy kept growing through all this, but always into a headwind.

However, by the end of 2016, the signs were gathering that the vigor of American economic growth was being accompanied by growth everywhere else.

Fears about Chinese overcapacity, and of yuan devaluation, have receded. And from Japan to Europe, South Korea to Brazil and Russia, there are signs of a world economy finally stirring. This is vindication for Carmen Reinhart and Kenneth Rogoff, whose research into over a hundred banking crises suggests that on average, incomes get back to pre-crisis levels only after eight long years.

Closer to home, the broad public has probably gotten it right even if trained economists like myself have been reticent and cautious. Recent rises in interest rates have confirmed that the world economy is gradually and surely lifting itself out of the woods after a sustained eight years of cleaning up balance sheets, keeping monetary policy loose, and applying fiscal stimulus wherever prudently possible. To be sure, the pace of progress has not been even around the world, but economies are stirring nevertheless.

In Hong Kong, the key macroeconomic indicators for aspiring homeowners to look out for are straightforward – unemployment, China’s economic performance, and the future path of interest rates.

Unemployment affects whether a person’s ability to service his mortgage loan will be negatively disrupted. It has been low throughout the past eight years because of an unusually tight labor market due to a rapidly ageing population and a declining workforce. The public no longer fears they cannot find work.

Chinese economic performance affects Hong Kong directly. People understand that steady economic growth on the Mainland will be good for Hong Kong, the region and the world. The millions in Hong Kong who regularly visit the Mainland have had ample opportunities to observe what is happening across the border and made up their own minds.

Even if opinions differ on what they see there, a number of them will conclude that things are looking up. That conclusion will lead some in Hong Kong to enter the property market. Moreover, as more individuals and companies from the Mainland invest in properties and property development in Hong Kong, the people here also have less reason to become worried about the future of the property market.

The people here are less concerned about interest rates rising ahead of economic growth. Eight years of US quantitative easing has not led to price inflation. They have been told repeatedly that interest rate movements will only follow anticipated inflation and a robust economic record, but will not move ahead of economic recovery. As an economist, I thing they are wise to think this way. I would conjecture that small increases in the interest rate would be sufficient for preventing inflation, without threatening or dampening economic recovery.

In today’s property market, only final users and long term-investors with excess liquidity have any interest in entering. Buyers are more concerned about affordability than appreciation potential over the short or medium term. All three macroeconomic indicators – unemployment, China’s economic performance, and the future path of interest rates – have given aspiring homeowners in Hong Kong sufficient comfort in late 2016 to enter the property market.

There are many other households who also want to become homeowners in Hong Kong, if only they could afford it. The cumulative number of marriages in Hong Kong from 1986-2015 was 1,744,737. Of that figure, 704,890 (or 40.4%) were cross-border marriages and 301,850 (or 17.3%) were remarriages registered in Hong Kong. Among remarriages registered in Hong Kong 140,797 (or 50.3%) were cross-border marriages. In 2015 alone, there were 56,937 marriages, of which 24,255 were cross-border marriages and 17,546 were remarriages registered in Hong Kong.

In the period 1986-2015, the cumulative gross number of new domestic housing units built was 1,571,659 (before deducting the number of units that were demolished). The number of units built in 2015 was 22,753. The unmet cumulative housing demand in terms of the number of units is phenomenal. This is why the estimated number of sub-divided units in the private sector is over 200,000, and part of the reason why housing prices and rents have skyrocketed.

Effects of Regulation on Markets

When prices soar due to shortages in the market, the public is naturally unhappy and blames the government. Throughout history, governments everywhere have responded by blaming speculators for causing prices to escalate. Their favorite policy is to penalize transactions by imposing levies to suppress prices. This works in the short run because buying and selling activities slow down and price increases are delayed. But shortages remain and inevitably prices will rise again.

Many decades ago, Mr. Henry Fok created a forward market for pre-selling units before their completion to spread risk and provide liquidity. The pre-sold units were tradable and were in fact actively traded. At the beginning, stamp duty was exempted on transactions in the forward market, which led to active trading activity there. In forward markets, it is not always easy to distinguish between speculators and final users, so trades were naturally viewed as speculative activities.

Developers, however, could use the price information revealed through speculative trades in the forward market to price the sale of new units that were released in batches over time. Speculation activity in the forward market helped developers, who have to sell large numbers of units in a single location within a limited period of time, to better diversify risk.

In a bid to prevent speculation, the stamp duties were extended to transactions in the forward market. High punitive stamp duties (including the special stamp duty and double stamp duty) have killed the incentive for speculators to trade units in the forward market. Furthermore, the government has also required developers to use lotteries to assign pre-sold units to prospective buyers, making it difficult to place the units with known speculators.

The elimination of the pre-sale forward market weakens the price discovery process. Prices are determined and, therefore, discovered through the buying and selling of units. Developers still pre-sell their new units before completion today, but trading activity in the forward market has disappeared. The elimination of speculative trades means developers now have less information to set prices correctly because there are fewer market transactions.

As a consequence, developers today are flooding the market with a lot of units at high mark-ups as soon as they detect some positive sign of buyer uptake. They are under intense competitive pressure, to sell their units to final buyers quickly, as they can no longer place units with speculators to hold them off the market. Mispricing has become more likely as markets have become highly regulated, contributing to greater price volatility.

Large developers could offer discounts and financing arrangements to cash-strapped buyers in the primary market, thereby inflating the nominal prices of units that they sell. Vendors in the secondary market typically are unable to match such offers and transactions there have dwindled (see Table). Between 2011 and 2016, annual secondary market transactions have decreased from 73,582 to 37,908 units. Meanwhile primary market transactions have increased from 10,880 to 16,793 units.

Table: Number of property transactions in the primary and secondary markets

| |

Primary market transactions |

Secondary market transactions |

| 2011 |

10,880 |

73,582 |

| 2012 |

12,968 |

68,365 |

| 2013 |

11,046 |

39,630 |

| 2014 |

16,857 |

46,950 |

| 2015 |

16,826 |

39,156 |

| 2016 |

16,793 |

37,908 |

The combined effect of punitive stamp duties and high initial down payments has thus been to raise the nominal price of units in the primary market and depress transactions in the secondary market.

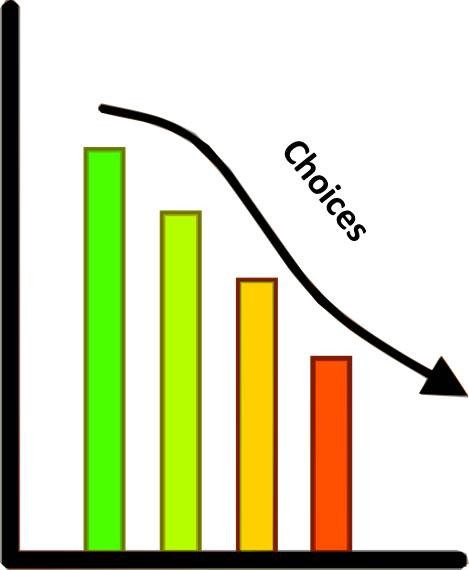

The net result for buyers has been to shift demand away from the secondary market to the primary market. The total supply of housing units on the market has been artificially reduced in the secondary market. Buyers now have less choice of units because of punitive stamp duties.

The regulation of property transactions can slow down price increases in the short run for politicians, who temporarily come out smelling like roses, but it is a futile means of holding down housing prices because the ultimate driver is excess demand.

When punitive stamp duties were imposed in late 2012 and early 2013, there were many who argued they would prevent a subsequent hard landing by dampening speculation.

Four and a half years down the road, we know speculation has been eliminated, but prices have not abated, and price collapses are not in sight.

The world economy is recovering, even if one may argue whether it will be a robust recovery. But it is certain that buyers have less choice as secondary market transactions have declined. And the forward market in pre-sale housing units – this great creation of Mr. Henry Fok – has been killed. I am puzzled why this has been celebrated as a huge policy success.

Chinese Version :

規管樓價細說從頭

王于漸教授 SBS JP

2015與2016年間本地樓價下跌約4% ,卻隨即在2016年底出乎意料地重拾升勢,發展商迅即抬高售價,推出大批預售新盤(俗稱「樓花」)應市;政府亦迅速增加懲罰性印花稅稅率,以防炒賣熱潮再起。

此舉顯然錯判形勢,其實市場上已再無投機者或短中期投資者,只剩下真正用家與資金充裕的長線投資者。今時今日,買家所關心的是能否負擔樓價,而非短中期內的升值潛力。

近期樓價回升,受兩個因素影響,其一為市民大眾對日後經濟的看法及對應否置業的影響。第二個因素,亦是令地產商急於把住宅單位以高價發售的原因:大量政府規限使樓花市場消失。

經濟前景考量

整體而言,2016年內充斥加息之說,市場上普遍預計,自2003年以來的樓價升勢應告一段落,逐步向下調整;美國聯儲局亦已先後四次預期加息,只因環球經濟依然疲弱,並未有付諸實行。

近10年來,本港樓市屢呈跌勢假象,期間每因歐羅危機、新興市場表現不穩、油價暴跌,以及憂慮中國經濟崩潰,對經濟復蘇的樂觀預期一掃而空。另一邊廂,美國經濟縱然持續增長,總不免受到逆風阻滯;及至2016年底,在美國經濟增長的同時,世界各地恢復增長的勢頭,則漸見有跡可尋。

對中國生產力過剩及人民幣貶值的顧慮,亦逐漸減退。從日本至歐洲,南韓以至巴西、俄羅斯,環球經濟陸續再現生機,足以證明Carmen Reinhart 與 Kenneth Rogoff所言非虛,兩位教授曾就百多次銀行危機進行研究,結果顯示,往往須經八年時間,方可回復至危機以前的收入水平。

聚焦香港,社會大眾亦能覺察到即使經濟學者亦持審慎態度、諱莫如深。近期美國宣佈加息,更印證過去八年來各國資產負債表已經整頓,貨幣政策保持寬鬆,加上適當地推行財政刺激方案,全球經濟正穩步回升。復蘇步伐也許不一,但回復增長之勢則殆無疑問。

本地有意置業者,可資參考的宏觀經濟指標有幾方面:失業情況、中國經濟表現、未來利率走勢。

失業情況足以影響個人按揭貸款的償還能力。近八年來,在人口急劇老化,勞動力日減的形勢下,勞工市場異常緊絀,失業率偏低,鮮見人浮於事的現象。

內地的經濟表現直接影響香港,眾所周知,其增長穩定性對本地、鄰近地區以至全球同樣有利;經常往返內地的港人,都會看見內地發展,對此更是心中有數。縱然意見各有不同,至少有部份人會認為整體經濟正在好轉,因而在香港樓市投資,隨着內地個人、機構的投資日增,港人更無須憂慮樓市的發展。

投資者其實並不擔心經濟增長前會加息。美國持續八年實行量化寬鬆措施,並未造成通貨膨脹,他們所接收的信息始終如一:利率只會隨預期通脹與蓬勃經濟變動,在經濟復蘇之前不會有所變動。我認為如此看法可算明智,相信輕微加息亦足以預防通脹,而不致威脅或拖累經濟復蘇。

正如上文所述,時至今日,市場上只剩下真正用家與資金豐厚的長線投資者;買家只關心能否負擔樓價,而非樓價短中期的升值潛力。失業情況、中國經濟表現、未來利率走勢三大因素,足令本地有意置業者有信心在2016年底入市。

事實上只要有能力負擔樓價,香港有意置業的家庭甚多。1986至2015年,香港累計婚姻達1,744,737宗,其中704,890宗(比率達40.4%)為跨境婚姻;在香港註册的再婚則有301,850宗(比率達17.3%)。在香港註册的再婚之中,又有140,797宗(比率達50.3%)為跨境婚姻。2015年,全港共計56,937宗婚姻之中,有24,255宗為跨境婚姻,17,546宗為在香港註冊的再婚。

1986至2015年的30年間,新落成住宅單位合共1,571,659個(未扣除已被拆卸的單位數字);2015一年內建成單位則達22,753個。房屋??